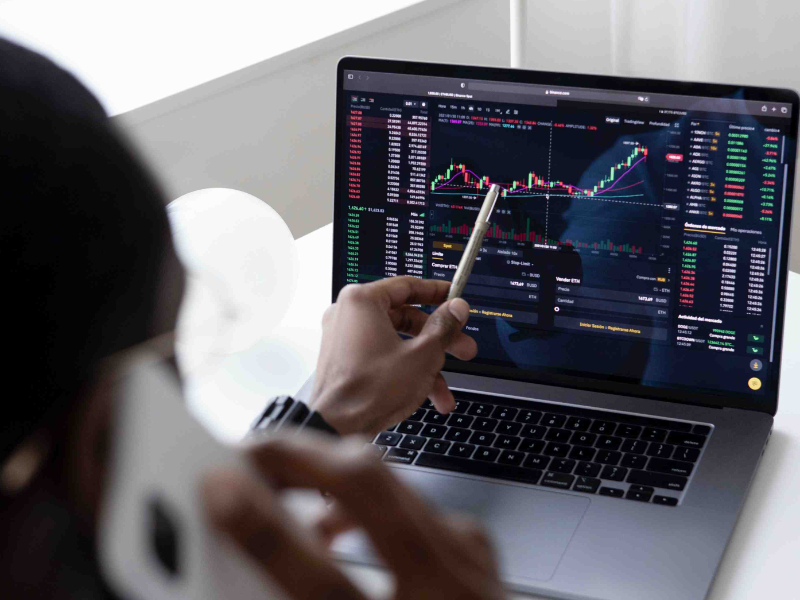

Pound cost averaging is an investment strategy where you invest a fixed amount of money into an asset at regular intervals over a set period of time. This approach aims to benefit from the price fluctuations of the chosen asset to potentially maximise returns.

Pound cost averaging and negative pound cost averaging are both investment strategies that can help to reduce risk, but they also carry some inherent risks. In this insight, we'll delve into how these strategies work, the benefits and drawbacks, and when it may be advisable to seek professional advice.

Assume an investor wants to purchase £1,000 worth of shares in a particular company. Instead of investing the full amount at once, they decide to spread out their purchases over 4 weeks, investing £250 each week.

| Week | Price per share (£) | Amount invested (£) | Shares purchased | Total shares | Average cost per share (£) |

|---|---|---|---|---|---|

| Week 1 | 10 | 1000 | 100 | 100 | 10 |

| Week 2 | 8 | 1000 | 125 | 225 | 8.89 |

| Week 3 | 12 | 1000 | 83.3 | 308.3 | 9.14 |

| Week 4 | 11 | 1000 | 90.9 | 399.2 | 9.29 |

By using pound cost averaging, the investor was able to purchase more shares when the price was low and fewer shares when the price was high. This approach resulted in a significantly lower average cost per share (£9.29) than the average price per share over the four-week period (£10.25).

Investors can use pound cost averaging as a strategy to reduce the risk of investing a large sum of money into an asset all at once. By investing a fixed amount of money at regular intervals, investors can spread out their asset purchases over time. This can help protect them from the risk of a sudden drop in the asset's price.

Pound cost averaging can also help investors take advantage of swings in the price of an asset. When the price of an asset is low, an investor can buy more of it with the fixed amount of money they are investing. This can potentially lead to higher returns when the asset price eventually rises.

While pound cost averaging can reduce investment risk, it's important to note that there are still risks associated with this strategy.

Negative pound cost averaging is another strategy investors may consider, but it also comes with its own risks. Seeking advice from a financial advisor can help investors determine whether pound cost averaging or negative pound cost averaging is the right strategy for their investment goals.

Timing the market can be a profitable strategy, but it's also risky. It involves predicting market trends to buy and sell shares at the right time. While some investors have succeeded in the past, there is no guarantee of success and the risk of loss is high due to the unpredictable nature of the stock market. This strategy also requires extensive research and analysis, which can be time-consuming.

Using pound cost averaging can help to reduce risk by spreading out the impact of short-term market fluctuations on the portfolio. By buying more shares when the price is low and fewer shares when the price is high, investors can achieve a more efficient portfolio diversification and potentially avoid major losses. This is the most obvious benefit of pound cost averaging.

Pound cost averaging is a simple and easy-to-implement investment strategy that requires minimal maintenance. Once an investor has established their investment plan, they can sit back and let the strategy work its magic. By investing small, regular amounts over a set period of time, an investor can potentially maximise their returns while minimising their risk exposure. This makes pound cost averaging an attractive option for those who are looking for a low-maintenance approach to investing.

Pound cost averaging spreads out the costs of purchasing an asset over time, resulting in a lower average price per share purchase. This can be beneficial for investors as it allows them to buy more shares when prices are low and fewer when prices are high. By doing so, the investor is able to potentially maximise their returns and minimise the impact of short-term market fluctuations on their overall portfolio.

Pound cost averaging is a strategy that can reduce the risk of sudden market fluctuations, but it may also limit potential gains.

By investing fixed amounts at regular intervals, an investor can benefit from the price volatility of an asset over time. However, this approach may lead to missing out on significant gains if the asset price rises quickly.

For example, let's say an investor starts investing £100 a month in a stock that is priced at £10 per share. Over the first few months, the share price fluctuates between £9 and £11, allowing the investor to buy more shares when the price is low. But if the share price suddenly jumps to £20, the investor may miss out on potential gains since they will only be buying a fixed amount each month.

Pound cost averaging can result in negative short-term returns since assets are purchased during unfavourable market conditions. This may prevent the portfolio from reaching its full potential.

Pound cost averaging requires the investor to stick with the same strategy for a long period of time, which does not allow for any flexibility. This lack of flexibility may result in missing out on potential gains or losses that may have been more profitable if the approach was more dynamic.

Negative pound cost averaging is a strategy where you choose to drawdown your pension in fixed installments, over a set period, rather than take a lump sum. The strategy is designed to help you benefit from potential growth by leaving a larger amount in your pension. However, you could end up worse off if the market takes a downturn as it's harder to recover.

Two individuals, Mr A and Mr B, both aged 67 with £100,000 pensions, withdraw £7,500 annually with a 2% increase. Over five years, Mr A's investments returned -10%, +4%, +4%, +4%, and +4%, resulting in a pension pot valued at just over £59,000. In contrast, Mr B experienced the same returns in a different order: +4%, +4%, +4%, +4%, -10%.

Despite the same returns, Mr B's pot is worth almost £69,000. The difference highlights the importance of timing in investments, with Mr A's adverse returns resulting in a £10,000 lower pension pot.

Overall, pound cost averaging is an effective way to reduce risk and stay disciplined when investing in the stock market. It can help investors protect their capital, maximise their returns, and focus on their long-term goals. However, the risks of negative performance are just as high. This strategy can be seen as a bit of a gamble. The stock market is difficult to predict. This sort of strategy is one best left the experts.

It can be worth it to seek professional financial advice as you approach retirement age or consider investing. It's important to consider the potential benefits of having a tailored plan. Advice can help you to understand the options available to you, and give you a clear view of how to make the most of your money.

If you are unsure where to start with retirement or investment planning, complete the Sunny Fact Find. The answers you provide help us to find the best-suited adviser. Your adviser then contacts you for a no-obligation conversation around how they can help. You decide how to proceed.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  Leicester, Leicestershire

Leicester, Leicestershire Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.